Until we were in the world of financial aid, we always wondered how financial aid eligibility is determined. Believe it or not, basic financial aid eligibility is pretty straightforward. It’s the college’s packaging policies (the way they award the aid for which a student is eligible) that gets complicated.

That’s for another day. Let’s take a look at how your eligibility for financial aid is determined.

Federal Student Financial Aid Eligibility

Most U.S. students will qualify for federal student aid. Here are the basic requirements:

You must…

- be a U.S. citizen or eligible noncitizen

- Have a valid Social Security number

- be registered with Selective Service if you’re male

- be enrolled or accepted for enrollment as a regular student in an eligible degree or certificate program

- be enrolled at least half-time in order to receive Direct Loans

- maintain satisfactory academic progress

- sign statements on the FAFSA asserting you are not in default on a federal student loan, don’t owe refund on a federal student grant and that you will use federal student aid only for educational purposes

- have a high school diploma, GED or completed high school in an approved homeschool setting

Free Application for Federal Student Aid (FAFSA Eligibility)

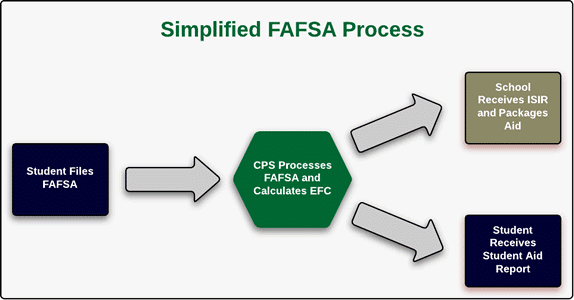

Simply put, if you want financial aid you have to file the FAFSA. The information you supply on the FAFSA will be used to determine your eligibility for federal student aid including federal student loans. State aid programs and colleges use the information from the processed results of your FAFSA to determine your eligibility for their programs.

Some private scholarships may also require you supply them with a copy of the Student Aid Report you receive once your FAFSA is processed to be considered for an award they offer.

Expected Family Contribution (EFC)

Colleges use the processed data from the Free Application for Federal Student Aid (FAFSA) and, in some cases, the CSS Profile to determine your eligibility for financial aid.

Whether you complete the FAFSA and, if required, the Profile, the basis for determining your award is a number referred to as the Expected Family Contribution (EFC). Your EFC is determined by your household, demographic and financial data among other things.

The EFC is a measure of your family’s ability to pay for college based on the following:

- student and parent income and asset information

- state of residence

- age of older parent

- household size, and

- number of household members in college

Cost of Attendance (COA)

The school you attend establishes a Cost of Attendance (COA) for the academic period for which you will be enrolled. The COA includes tuition, room and board, fees and estimated living expenses including books and supplies.

Financial Need

Financial need is an official term for how much need-based financial aid you’re eligible to receive. Your financial need is calculated by subtracting the EFC from the COA. In order for you to receive need-based aid, your Cost of Attendance must be greater than your Expected Family Contribution.

COA – EFC = Financial Need

The financial aid office at your school will use the need-based resources they have available to try to meet your Financial Need.

Financial Aid Award Letter

Let’s take what we’ve learned so far and see how it might apply a hypothetical student we’ll call Emily.

Emily filed her FAFSA online on January 15th. She filed using her PIN and was able to access her Student Aid Report (SAR) on January 20th.

The EFC reported on her SAR is $1,200. The private 4-year college she wishes to attend has a COA of $24,000. Using the formula above, Emily figured out that her Financial Need is $22,800.

The financial aid office at Emily’s school uses their COA and her calculated need to construct a financial aid package. Here’s an example of the awards and amounts Emily might receive from her school:

| Cost of Attendance – Expected Family Contribution = Financial Need | $24,000 $1,200 $22,800 |

| Financial Aid Program | Annual Amount |

| Gift Aid | |

| Grant from College | $8,000 |

| Federal Pell Grant | $4,580 |

| Federal Supplemental Educational Opportunity Grant | $2,000 |

| Self Help Aid | |

| Federal Subsidized Direct Loan | $3,500 |

| Federal Unsubsidized Direct Loan | $2,000 |

| Federal Perkins Loan | $1,000 |

| Net Cost: $2,920 | |

| Options to Pay Net Costs | |

| Federal Work-Study | $1,800 |

| Family Contribution (EFC), Federal Parent Direct PLUS Loan, Private Student Loan, Military Benefits, Tuition Payment Plan from School |

In our example of qualifying for financial aid, Emily’s financial aid office was able to meet nearly all of her financial need with a combination of grants, loans and work-study. You’ll notice that she will have a net cost of $2,920.

Her actual bill may vary from the net cost indicated on her award letter because her actual expenses for things like room and board, books and personal expenses might be different from what the college budgets in their Cost of Attendance.

As the example notes, there are a number of different options for Emily and she can use one or more of each to cover her costs. You’ll note that we don’t include Federal Work-Study when calculating net costs because work-study is earned through work and received in the form of a paycheck.

Most students use the money they earn through work-study to cover personal expenses.

The above is just an example of the kinds of aid that a student like Emily might receive. Learn more about the types of financial aid.