Chart the Right Course with Our Financial Aid Flowchart

Let’s face it, navigating the financial aid seas can be a tumultuous process. With today’s abundance of options and offers, students have a tough task of finding the most prudent course to college funding that won’t set them adrift. Many find themselves in over their heads, so we’re throwing out this ‘financial aid’ life preserver, our financial aid flowchart, to help keep them afloat.

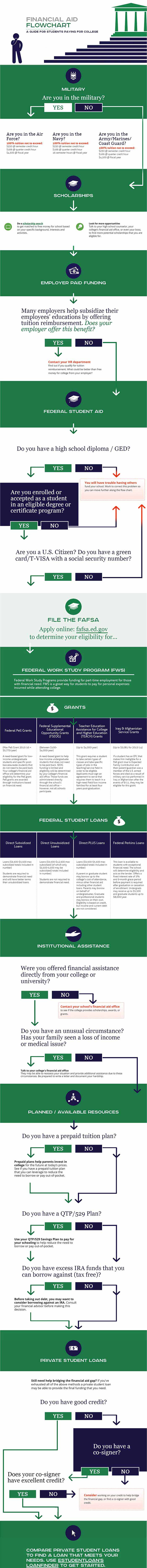

In an effort to help students choose the most fiscally responsible route for financial aid, we’ve created an interactive Financial Aid Flowchart. This flowchart will help guide students, step-by-step, down a cautious path towards finding money for college that’s as easy as treading water.

We start by navigating students through scholarships and grants, then through additional types of non-traditional funding, such as employer tuition assistance programs. Continuing to follow the map, we then proceed to pre-planned resources and the proper student loan process.

Getting this process right is crucial, as there are serious financial ramifications when borrowing large amounts of money. Students should do their homework by reviewing all of their options, following a plan (as suggested by this flowchart), and applying themselves. When done correctly, they can graduate with lower student loan amounts and better interest rates, which also leads to lower payments.

To get started, students simply need to head over to our Financial Aid Flowchart, read each question, and click accordingly. Each answer will whisk students off to the next logical step in their college funding plan.

To help financial aid officers, guidance counselors, and students that would like a graphic or print out of the Financial Aid Flowchart, we created versions that can be added to a website or printed as a PDF.

Bon voyage and good luck!

STEP 1: MILITARY

ARE YOU IN THE MILITARY? MAXIMIZE YOU TUITION BENEFITS

AIR FORCE

100% tuition not to exceed:$250 @ semester credit hour$166 @ quarter credit hour$4,500 @ fiscal year

NAVY

100% tuition not to exceed:$250 @ semester credit hour$166 @ quarter credit hour16 semester hours @ fiscal year

ARMY/MARINES/ COAST GUARD

100% tuition not to exceed:$250 @ semester credit hour$166 @ quarter credit hour$4,500 @ fiscal year

STEP 2: SCHOLARSHIPS

Do a scholarship search to get matched to free money for school based on your specific background, interests and activities.

Look for more opportunitiesTalk to your high school counselor, your college’s financial aid office, or even your boss, to find more potential scholarships that you are eligible for.

STEP 3: EMPLOYER PAID FUNDING

Many employers help subsidize their employees’ educations by offering tuition reimbursement. Does your employer offer this benefit? Contact your HR department to find out if you qualify for tuition reimbursement. What could be better than free money for college from your employer?

STEP 4: FEDERAL STUDENT AID

To qualify for Federal Student Aid, generally you must meet certain conditions.

- Make sure you graduate high school! Without a high school diploma / GED you will have trouble having others fund your higher education.

- Are you enrolled or accepted as a student in an eligible degree or certificate program?

- Are you a U.S. Citizen? Do you have a green card/T-VISA with a social security number?

FILE THE FAFSA!

Apply online: fafsa.ed.gov to determine your eligibility for…

FEDERAL WORK STUDY PROGRAM (FWS)

Federal Work Study Programs provide funding for part-time employment for those with financial need. FWS is a great way for students to pay for personal expenses incurred while attending college.

GRANTS

Federal Pell Grants:& Max Pell Grant 2015/16 = $5,775/year

A need-based grant for low-income undergraduate students and specific post-baccalaureate students that do not need to be paid back. Your college’s financial aid office will determine your eligibility for the Pell grant. Pell grants are awarded through institutions based on financial need.

Federal Supplemental Educational Opportunity Grants (FSEOG): Between $100-$4,000/year

A need-based grant to help low-income undergraduate students that does not need to be paid back. SEOG funding is limited and eligibility will be determined by your college’s financial aid office. These funds are administered directly through the school’s financial aid office — however, not all schools participate.

Teacher Education Assistance for College and Higher Education (TEACH) Grants: Up to $4,000/year

This grant requires a student to take certain types of classes and take specific types of jobs in the teaching/service field in order to be eligible. Applicants must sign an agreement to serve that requires them to teach in a high-need field/low income families/for at least four years post-graduation.

Iraq & Afghanistan Service Grants: Up to $5,081 for 2013/14

If a student has an EFC that makes him ineligible for a Pell grant due to Expected Family Contribution and their parent/guardian was a member of the U.S. armed forces and died as a result of military service performed in Iraq or Afghanistan after the events of 9/11, they may be eligible for this grant.

FEDERAL STUDENT LOANS

Direct Subsidized Loans: Loans $3,500-$5,500 max subsidized totals included in number

Students are required to demonstrate financial need and will have better terms than unsubsidized loans.

Direct Unsubsidized Loans: Loans $5,500-$12,500 max subsidized of which only $3,500-5,500 may be subsidized totals included in number

Students are not required to demonstrate financial need.

Direct PLUS Loans: Loans $3,500-$5,500 max subsidized totals included in number

A parent or graduate student may borrow up to the college’s cost of attendance, minus other financial aid including other student loans. Parents may borrow on behalf of undergraduates. Graduate and professional students may borrow on their own. Eligibility is based on credit, but income and current debt are not considered.

Federal Perkins Loans: This loan is available to students with exceptional financial need. The school will determine eligibility and acts as the lender. Offers a fixed interest rate of 5% and 9-month grace period before payment is required after graduation or cessation of enrollment. Undergrads may receive up to $5,500 and graduate students up to $8,000/year.

STEP 5: INSTITUTIONAL ASSISTANCE

Were you offered financial assistance directly from your college or university? If yes that’s great! If not, contact your school’s financial aid office to see if the college provides scholarships, awards or grants.

If you have an unusual circumstance such as family loss of income or medical issues also contact your school’s financial aid office. They may be able to reassess your situation and provide additional assistance due to these circumstances. Be prepared to write a letter and document your hardship.

STEP 6: PLANNED / AVAILABLE RESOURCES

Do you have a prepaid tuition plan? Prepaid plans help parents invest in college for the future at today’s prices. See if you have a prepaid tuition plan that you can leverage to reduce the need to borrow or pay out-of-pocket.

Do you have a QTP/529 Plan? Use your QTP/529 Savings Plan to pay for your schooling to help reduce the need to borrow or pay out-of-pocket.

Do you have excess IRA funds that you can borrow against (tax free)? Before taking out debt, you may want to consider borrowing against an IRA. Consult your financial advisor before making this decision.

STEP 7: PRIVATE STUDENT LOANS

Still need help bridging the financial aid gap? If you’ve exhausted all of the above methods a private student loan may be able to provide the final funding that you need.

Do you have good credit?

Do you have a co-signer? If you have poor credit, a co-signer may strengthen your chances of receiving a loan.

Compare private student loans to find a loan that meets your needs. Use eStudentLoan’s LoanFinder to get started.